Common Documents Used in International Trade – Focus: Airfreight

Common documents used in international trade with reference to air cargo are usually the commercial invoice and the packing list. That is the minimum requirement. The primary focus, here, is to documents that accompany the air shipment. The secondary focus is on documents that might be needed. Papers that accompany the shipment carry a very great importance.

A Few of the Common Papers Used in International Trade

Before going into details of documents required, here is a general list of the paperwork that are needed during export.

A general list of the most common documentation that accompany air shipment

- Commercial Invoice

- Packing list

- Consular invoice

- Certificate of Origin

- Certificate of Conformity

- Pro-Forma invoice

- ATA Carnet (for exhibition goods, which will return as they are)

- Export Declaration (needed only for the country of export)

Commercial Invoice, Pro-Forma Invoice – Which one?

The choice should be almost always commercial invoice, because in many countries, the customs authorities might refuse to accept a pro-forma invoice as a valid document. The customs office can demand a commercial invoice before clearing the goods. Among the commonly used documents in global trade, commercial invoice is almost always present.

What if Only a Pro-Forma Invoice is available?

If the customs authorities refuse to accept a pro-forma invoice and if a commercial invoice is not readily available, the consignment will be put on hold. The customs clearance will not take place. The goods will remain in the bonded warehouse and if the free storage period is over, demurrage charges will begin.

Demurrage Charges or Storage Charges – That Can be Very High

Storage charges might be low on very small air cargo. However, the charges can be extremely high, when the consignment is very large. The reason is simple. Storage charges are applied per kilo per day. The charges are usually applied to chargeable weight and not the gross weight.

Between the gross weight of the shipment and the volume weight, whichever is higher will be the chargeable weight.

Consular Invoice

What is a consular invoice? Some of the countries, such as Saudi Arabia, can demand a consular invoice. This is a commercial invoice verified and stamped by the consulate of the importing country. The invoice will, usually carry the air waybill number, the stamp of the consulate and the signature of the certifying officer.

Not a Very Common Document in International Trade – Restrictions

A consular invoice is not a very common used document in international trade, as only a few countries demand it.However, when one must include it, one must know the restrictions.

If the air waybill number is mentioned on the consular invoice, the booking must be done using exactly that air waybill. That means, the shipper is bound to the airline and the air waybill number. A deviation will cause the invoice to be considered invalid and the shipment will face clearance problems.

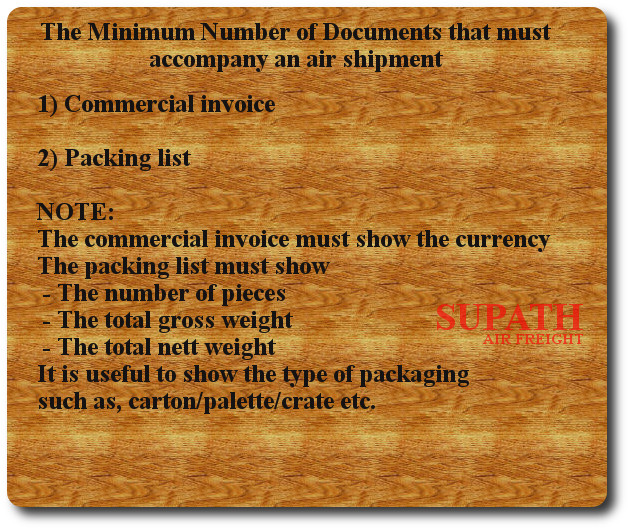

Common Papers in International Trade – The Minimum Set

What is the minimum set of commonly used documents? The simplest answer is

- Commercial invoice

- Packing list

The above mentioned documents make up the minimum set of papers that must accompany an air shipment.

Understanding Documents – Parties to the Air Freight Contract

In order to understand the necessity of documents, we need to have a holistic view of the air export freight forwarding process.

The three parties in the process are

- The shipper

- The freight forwarders (shipping agent and consignee agent)

- The importer

The shipper needs the commercial invoice to apply for the export declaration. The shipping freight forwards needs the export declaration to apply for the release of the goods for export. The consignee agent needs the documents to prepare the bill of entry for importing the goods

The Stages of the Documents – From Creation To Final Clearance

Follow the rules of the country of export and of the country of import. Request information from the consignee regarding the requirements at the airport of destination. The local chamber of commerce will help with the export requirements.

The Documents – Standard Requirements

The papers have to be on the letterhead of the company and not on a blank piece of paper. Brazil, for example, demands the invoice text to be in Portuguese and the documents be signed and stamped.

Brevity, Clarity but also Detailed – Essential Information

Keep the commercial invoice clear and precise. Customs authorities will not understand your abbreviations. Add clear text to the commercial invoice. Consider a situation, which a customer broker calls “document review”

Document Review: The customs asks the broker to table the documents accompanying the freight.

What do the Customs Officers Want to Know – An Objective View

Using abbreviations in the commercial invoice might cause irritation. An quick identification might not be possible. Try to understand what the customs office wants to know.

The customs authorities want to know

- The composition of the product (material used)

- The functionality : the use, the function of the product

- Origin of the product (the country of origin)

- The final consignee (“the company that will take receipt of the product”

- The end point of transport (where will the product finally be stationed)

The Background of the Customs Inspection – Document Review or Inspection of Goods

What does the customs office look for in an inspection? Some of the questions are as below :

- Is there any restriction on the goods?

- Does the law restrict the use of a certain combination of materials in a product?

- Are there any prohibited items in the goods?

- Is the import of such goods prohibited by law?

- Does the classification of the goods correspond to the physical goods?

- Do the descriptions on the documents tally with the product?

Time – The Important Factor That May Not be Overlooked

The customs officer looks for information, which will help him identify the product. The faster he can identify, the faster his processing. If the document only shows abbreviations and code numbers, he will need more time to decide and clearance will take a longer time.

The Freight Forwarder and The Customs Office – The Mutual Factors

Before the airline can enact its role, two parties have to play their part, viz. the freight forwarder and the customs office.

In a typical exports control procedure, the customs officer wants to know what is being exported, to where, to whom and with what documents. He will then check if the export of that product is permissible. He will also check if there is any embargo in place. Hence, the clarity of the document will help save time.

A short list

- Identifiable name(s) of the product(s)

- Quantity with unit

- Weight with unit

- Type of packaging: carton, pallet, crate etc.

- Dimensions with unit: Length x Width x Height cm/in/mm

- Total number of pieces

- Total gross weight of the consignment

Below, the same list is repeated in a different way.

Not all documents can be covered here. However, the most important points are highlighted below

Commercial Invoice and Packing List

These two documents should, ideally, carry the following information

- Title (Commercial invoice/Pro-Forma Invoice/Packing List)

- Date

- Name and address of the shipper and the consignee

- Description of goods (not codings or abbreviations)

- Serial numbers of the products (if applicable)

- Currency

- Packaging information: number of pieces, type of packaging (cartons, pallets etc), dimensions and units (cm, in)

Item 4 is a must if the product is to be temporarily imported. When the product is re-exported after the set time, the customs authorities will demand the identification based on serial numbers. The customs documents will carry the original serial number.

Caution : Exporting items that will return to the country of export:

Keep in mind these important aspects

Keep ALL the documents, that were used during the initial export.

There is a time limit for re-importing under “returning after temporary export“, a process which is used to import goods, without duties being applicable. Ask the relevant customs office!

To avail of exemption of duties applicable to re-import of goods, it must be be borne in mind that the such goods may not have undergone any physical change. In other words, the import of goods must comply with the principle of “unprocessed goods”. Example: A machine exported may be used for demonstration purposes abroad. However no changes are to be made to the machine. That includes changing any parts, “upgrading” it with new parts etc. In short “no physical change” or ” no change in appearance and functionality” may be effected.

In addition to the above, before exporting, make documentary evidence of the goods. This is achieved by serial numbers embossed on the item. The number is then mentioned on the accompanying documents such as packing list, commercial/pro-forma invoice etc.

The import after the demonstration abroad must be done within the relevant period set by customs.

Certificate of Origin

This is issued by an authorised office and most customs offices will demand the original during import processing. Hence, do not delay! You may send the document to the consignee in advance. Do not use standard postal service! Instead use a courier service. Always keep a clear digital copy on hand. A digital copy should be sent to the consignee by mail.

REX System – The Registered Exporter System of the European Union

The European Union, in 2010, introduced the REX system. This was done by amending the Regulation (EU) 1063/2010 in the context of the General System of Preferences that laid down the rules of the origin of goods. The implementation of the system was deferred to 2017.

What is the REX (Registered Exporter) System?

REX is a self-certification system by economic operators. As an initial step, the economic operator carries out a registration with the competent government authority of the state. Once that is done, he is authorised to print a certification on the commercial invoice/packing list of the goods. The economic operator is given a registration number, by the competent authority and this number will appear in the certification text.

Advantages of the REX System for the Importer

As per the rules in the GSP (Generalised System of Preferences, the the REX certification on the document will reduce the amount of duties levied on the goods. Certain goods are, as a result of the regulation, exempted from duties.

ATA Carnet

ATA Carnet is a document used for temporary import into a country that is part of the ATA Carnet agreement. Some offices attach a seal to the Carnet! Do NOT damage this! No pages are to be removed.

ATA Carnets are international customs documents permitting the duty-free and tax-free export and import of goods up to one year – International Chamber of Commerce

ATA Carnet is to be kept safely. It will accompany the shipment until the return to the station of origin, where the document will officially be cancelled, thus completing the procedure.

A very clear copy is to be sent to the consignee(or his cargo agent) to help him prepare the customs bill of entry.

Veterinary Certificate

If you are exporting dairy products, meat etc, get in touch with the corresponding government authority or the chamber of commerce. Prepare all the necessary documents without any mistakes.

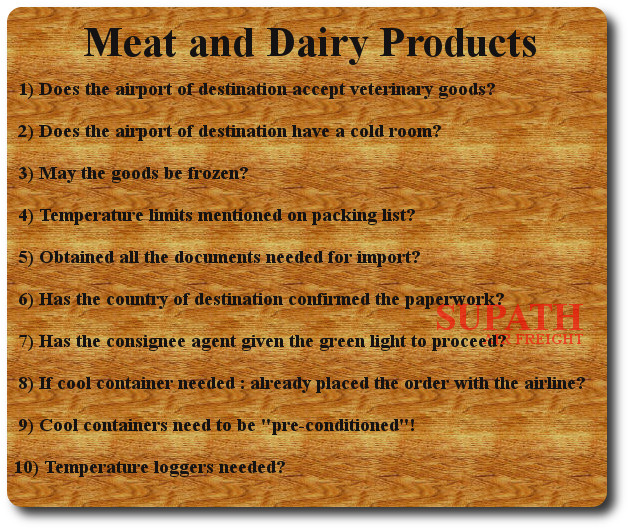

Exporting Meat and Dairy Products – Check List

A small diversion from the discussion on common papers used in international trade. This is for those who are into exporting meat and dairy products. The list below is, certainly, not exhaustive but it covers a few of the most important questions

The Check List for Preparing Export of Meat and Dairy Products

- Does the airport of destination accept veterinary goods?

- Is there a cold room at the airport of destination?

- May the goods be frozen? or only cooled?

- Temperature limits mentioned on packing list?

- Obtained all the documents the importer needs?

- Has the country of import confirmed the paperwork?

- Has the consignee agent given the green light to proceed?

- If cool container needed : Order placed with the airline?

- Cool Containers need to be pre-conditioned! Time is needed

- Temperature loggers needed during transport? Ordered? Tested?

Make Clear Copies, Await Approval From Consignee Agent

Make clear digital copies of the certificate and send it to the forwarder (cargo agent) at the airport of destination. He may need to consult with the local veterinary officer to know if anything more is needed or if the certificate is OK. Move the goods ONLY AFTER the approval has been received.

Give the Consignee Time to Prepare his Set of Papers

The consignee will also need, in most cases, a permit from a government office to import such goods. Not all airports will have a serving veterinary officer. Hence, confirmation regarding the airport of arrival must be obtained prior to export.

Be Prepared for Delays, for Emergencies – Faulty Documentation?

Think ahead. Successful tendering to the airline is not the end of the story. When the consignment arrives at the airport of destination, the customs need to release the goods. This can happen only after clearance. What happens if the customs offices declares your documents as insufficient or inadequate or incomplete? What happens, if the customs officer demands further documents?

Exporting Items Made of Wood – Scientific Name of Wood Needed

Items made out of wood will almost always require the scientific names of the trees from which the item has been manufactured. Provide the consignee with the official scientific name. The scientific name should be printed on the documents

Items of Animal Origin – Not So Common Documents in International Trade

Items of animal origin (feather, hide etc) must be described with the corresponding scientific names of animals.

CITES – Convention on International Trade in Endangered of Wild Fauna and Flora

If the item is a leather product, check for requirement of CITES certificates. If a certificate is needed but is not available, the consignment will be blocked. If no certificate can be produced, import will not only be prohibited but the authorities can take action.

What is CITES? CITES (the Convention on International Trade in Endangered Species of Wild Fauna and Flora) is an international agreement between governments. Its aim is to ensure that international trade in specimens of wild animals and plants does not threaten their survival. – CITES

Demurrage – Absence of Documentation can Cause Storage

When the clearance cannot be completed due to absence of documents or any other reason, the consignment will remain under the custody of the customs office and after the expiry of the free time (between 24 hours and 72 hours calculated from the landing time) storage charges will start.

The usual demurrage is a rate per kg per day (A minimum price will apply). The rate is applicable on chargeable weight and if your shipment is a large one, the price for storage (demurrage) will be high.

Checking In Advance

Prevention is better than cure. The principle applies even to air freight! Documents in international trade need to be checked in advance. This will help you to minimise the risks. This procedure will help you to keep a control on costs, to avoid unnecessary stress, to prevent wastage of time.

This should be an inseparable part of your quality control. Your customer needs to receive his order on time. You need to receive your payment on time.You also need to make sure that the customer is kept happy. Service goes beyond the airport.

Ask Yourself These Questions

- Have you requested and received a list of documents your customer needs?

- Have you passed on to your customer copies of the documents for his perusal and confirmation?

- Have you received from your customer the go ahead regarding the documents?

- Have you passed on very clear digital copies of the documents to the freight forwarder, at your end?

- Can the freight forwarder (cargo agent) or broker at the airport of destination use, without any hitch, the documents to file the customs bill of entry? Remember: A commercial invoice, or for that matter, a packing list, which contains only abbreviations and codings is of no use to the broker. He needs to enter the nature and description of the goods into the bill of entry that he will sent to the customs office.

- Does the consignee need an import licence?

- If he needs one, has he applied for it? It is not to your advantage to say that the sales terms are EXW (ex works) and that it is the importers job to think about that. The more information you can give and the more help you can provide, the more satisfied will your client be.

- Have you provided the shipment details, such as dimensions (with units please), weight etc. in your documents? The broker might be required to enter the nett weight (weight of the goods without the packaging) to the customs. If you say “one piece”, you are making it difficult for the broker to “guess”. A single carton might weigh only one kilo, but a pallet might weigh 25 kilos.

- Does the country of destination accept “pro-forma” invoice? Many do not!!

- Have you entered the text “For custom purposes only” on your invoice? If you have, did you think that the country of destination might disqualify such a document? The same applies to ” No commercial value”.

- In the case of a temporary import: have you entered the serial number of your product(s) on the commercial document or any other document, which will be used for re-export?

- Have you placed your signature (in blue ink!!) on the commercial invoice AND the packing list? Some countries make it mandatory.

- Have you spelt the consignee (and the address) correctly? (Some countries will give you sleepless nights, if there are “spelling mistakes” in the consignee’s name and address (speaking from experience)

There are more questions, but I do not wish to worry you. I am just speaking from experience and it is my wish that you export your goods with as less problems as possible. If you have a lot of exports and less time on your hands, let a professional manage it for you. After all Rome was not built in a day.

Common documents in international trade are no cryptic puzzles. All that you need is good organisation and a good planing. Arm yourself with knowledge. Countries keep changing laws and that affects trade, as well. You know it, knowledge is power.

Special Papers – Extra Attention

Certain documents in international trade demand extra attention. This is not to frighten you. You just need to take care not to lose, damage or misplace certain very special papers. I shall name some of them here:

- Certificate of Origin Form

- EUR 1

- ATR (Turkey)

- ATA Carnet

- CITES Certificate

- Veterinary Certificate

- Documents relating to dairy and meat products

May the Receiver of the Goods See the Commercial Invoice?

The shipper must answer this question. Who is paying for the goods? Who is receiving the goods? The party that is paying for the goods might be selling to the receiver with a profit margin. Hence, the receiving party may not see the commercial invoice.

Neutralisation – Protecting The Valuable Data

In many such cases, the goods are neutralised. This means that the consignment will be stripped of any paper or label that will show the original shipper. The shipment is delivered as an anonymous one. the receiving party knows only the company that sold the goods to him.

In such a case, do not pass on the commercial invoice to the freight forwarder. The forwarder at the airport of destination will be given a commercial invoice for the customs clearance.

Export Declaration

This is a document that is needed only up to the airport of exit. It is issued by the local customs authority of the shipper. In some cases, the goods are not in the custody of the shipper. It may be located in the warehouse run by another company.

In the latter case, the export declaration is issued by the local customs office of place where the freight is located. For example, the shipper is located in Paris but the goods are physically stored in Frankfurt, Germany. The local customs office, under whose jurisdiction, the warehouse is, needs to issue the declaration.

The local forwarder will know when the document is required. In Germany, when the commercial invoice(s) carries a value of 1000EUR or more or if the consignment is above 1000 kg, an export declaration is mandatory. The document carries an 18 digit (character) code called MRN (Movement Reference Number). The last digit is called a check digit.

The German export declaration (called ABD, the abbreviation for Ausfuhrbegleitdocument. It means “Document accompanying the goods for export) is valid for 90 days from the date of issue.

Conclusion

Draw up a check list of the documents required. Ask yourself the questions mentioned in the section above. Plan without loopholes. Keep your lines of communication open. Documents used in international trade have no short cuts. You may get in touch with me here.